The indirect tax levied upon the supply of goods and services is called GST (Goods and Service Tax) in India. The business registered under GST alone is legally recognized as a supplier of Goods or Services. Any business like a partnership or a sole proprietor can also register for GST even if there is no physical place of business.

All about a Consent Letter for GST Registration

Several businesses are now carried out without any registration and consent letter. Such companies are not considered legal.

It is mandatory under GST law that –

- If the place of business carried out by a person is neither owned nor rented, it requires a no-objection certificate called a consent letter from the owner of the premises.

- The NOC should state that they don’t have any objection to the taxpayer using the premises for business.

If the place of business is in the taxpayer’s name, then an ownership document is required, and if the place of business is rented, then a rental agreement is needed during GST Registration.

Who must sign a consent Letter For GST Registration?

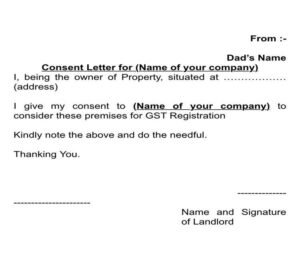

The premises owner should sign the consent letter for gst registration. There is no specific format for Consent Letter. However, if you want to get your hands on gst certificate download by gst number, you can click here for more information. On some special occasions, a GST Officer might demand the signed consent letter in stamp paper. In such cases, it should be signed on stamp paper.

Documents Required along with the Consent Letter

The consent letter should be submitted along with the proof of company address, such as municipal khata copy or electricity bill, whichever from the above two is accepted.

What are the Steps for Uploading the signed Consent Letter on the GST Portal?

The steps are as follows:

- Step 1: Visit the GST Portal and select services > Registration > New Registration.

- Step 2: While filling the form under the nature of possession of premises, select “Consent.” If the taxpayer uses the rented premises or the premises of a relative for carrying out the business, the owner of the premises must sign the consent letter.

- Step 3: The consent Letter needs to be uploaded in either PDF or JPEG format, and the file size must not exceed more than 1MB.

After submitting, the GST certificate is downloaded by the GST Number. Thus the whole process of GST Registration is now complete.

What happens if a Taxpayer Forgets to Submit a Consent Letter?

In any case, if the Taxpayer forgets to upload Consent Letter and address proof while filing GST Registration, in such cases, the GST Officer will communicate with the Taxpayer via email or phone. After receiving such notice, a taxpayer can attach the consent letter GST Registration form.

Conclusion

The GST Registration process is complete only when the taxpayer uploads the document of ownership/lease agreement/ consent letter of the commercial place where the business is carried out. GST Registration provides legal recognition for businesses.